By Adam Pagnucco.

Once again, Montgomery County’s liquor monopoly is a hot issue in local politics. As far as we know, MoCo is the only county in the nation in which the county government has a monopoly on the distribution of beer, wine and spirits and also a monopoly on retail sales of spirits. Candidates for office disagree on whether it is needed. In a response to David Lublin’s recent post on the subject, Department of Liquor Control (DLC) Director Bob Dorfman claims it has improved.

Has it?

We will give the monopoly credit for one thing: it did not see system-wide distribution failures in the critical week between Christmas and New Year’s last year as it did in 2015 and 2016. That has not stopped two anti-monopoly groups from forming in the last few months, one representing licensees and another representing consumers. But what’s really going on? Let’s look at the data.

According to Gallup and the U.S. Department of Health and Human Services, alcohol consumption tends to be correlated with education and income. That makes sense – people with college and graduate degrees tend to make more money, and people with more disposable income have more money available for alcohol purchases. MoCo has lots of highly educated and wealthy people so we should be one of the leaders in alcohol spending in Maryland.

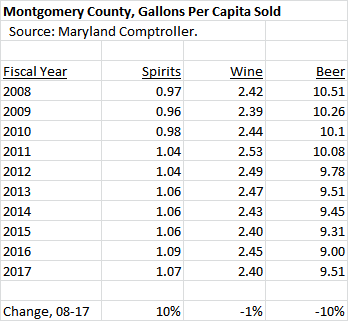

The Comptroller of Maryland, who collects alcohol taxes, posts annual reports of alcohol sales per capita for each of Maryland’s twenty-four jurisdictions on his website. We collected the last ten fiscal years of that data and present it below. Let’s remember when recent changes at the DLC occurred. After many revelations of bad performance in 2014, DLC launched an “Action Plan” to improve performance in June 2015. George Griffin, the former DLC Director who was blamed for the first New Year’s Eve meltdown, left in January 2016, about halfway through Fiscal Year 2016 (which ended on June 30). Bob Dorfman, the new DLC Director, started in December 2016, about halfway through Fiscal Year 2017. If these events were associated with genuine operational improvements, we would expect to see significant increases in both per capita sales and rank among jurisdictions over the last three years.

That has not happened.

Below is data on per capita sales of spirits, wine and beer in Montgomery County over the last ten fiscal years.

Spirits sales per capita have increased over the last decade, although they have barely changed since 2013. Wine is stagnant. Both wine and spirits fell in FY17, the first year of the new Director. Beer sales per capita are down over the last decade and rose slightly in FY17. But here’s the thing: MoCo’s new craft breweries are exempted from the liquor monopoly and, as a result, are doing really well. The tiny gain in beer could be due to FREEDOM from the monopoly, not better operations at the monopoly.

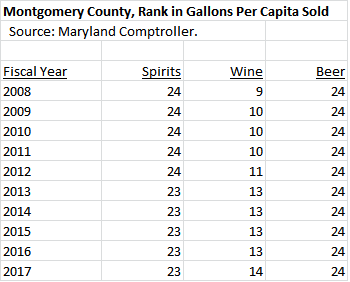

Now let’s compare MoCo’s rank in per capita sales to the 23 other local jurisdictions in Maryland.

Because of its education and wealth, MoCo should be one of the leading counties in per capita alcohol sales. It’s not. In terms of spirits, the only county that’s worse is Somerset, which perhaps not coincidentally has its own monopoly on spirits sales. In terms of beer, MoCo is dead last. In terms of wine, MoCo has slid from ninth in the state to fourteenth, moving down a spot in FY17. Jurisdictions in which residents bought more wine per capita than MoCo in FY17 included Anne Arundel, Baltimore City, Baltimore County, Calvert, Carroll, Cecil, Frederick, Garrett, Harford, Howard, Kent, Talbot and Worcester. Does anyone believe that residents of counties with two-thirds of MoCo’s household income (or less) drink more wine than we do?

What’s happening is that consumers leave the county to buy alcohol. That’s why numerous D.C. liquor stores are located within blocks of the MoCo border. That’s why a fifth to a quarter of customers at Total Wine stores in McLean and Laurel come from MoCo. The state’s Bureau of Revenue Estimates found that if MoCo customers were to return to the county to shop for alcohol in the absence of the liquor monopoly, the county would see a surge of almost $200 million in new economic activity, enabling a path forward for the county to replace every cent of lost revenue.

Dorfman is a better manager than his predecessor and we believe he is genuinely trying to improve DLC. But Dorfman won’t be there forever and DLC has a long history of problems. The monopoly also has a long history of promising improvement, mostly resulting in fleeting or ineffective fixes with quick relapses. Even modest liberalization passed by the General Assembly to allow some private retail sales of spirits has been blocked. What the above data on per capita alcohol sales shows is that, despite claims to the contrary, not much has changed. And unless MoCo starts behaving like a normal county and allows private sector competition, true change may never come.