By Adam Pagnucco.

Picture this, dear readers: two events, both scheduled for today.

Picture 1: Robin Ficker, author of numerous charter amendments on taxes and term limits, has announced his intention to deliver 16,000 signatures in support of his latest anti-tax amendment to the county executive’s office. Ficker needs at least 10,000 signatures to place his amendment on the ballot. Let’s remember that no one in the history of Montgomery County has more experience in gathering signatures than Robin Ficker.

Picture 2: Just a short walk away in the county council building and almost simultaneously, County Council Member Will Jawando and Delegate Julie Palakovich Carr have announced a press conference in support of two state bills that would enable the county to levy tax hikes. One bill would allow counties to set different property tax rates for commercial properties, industrial properties and residential properties with more than 5,000 square feet. The other bill would allow counties to increase their maximum income tax rates from 3.2% to 3.5% and establish income tax brackets.

Picture 1 is to be expected; we have seen Ficker’s grandiose signature deliveries before. Picture 2 is problematic for two reasons.

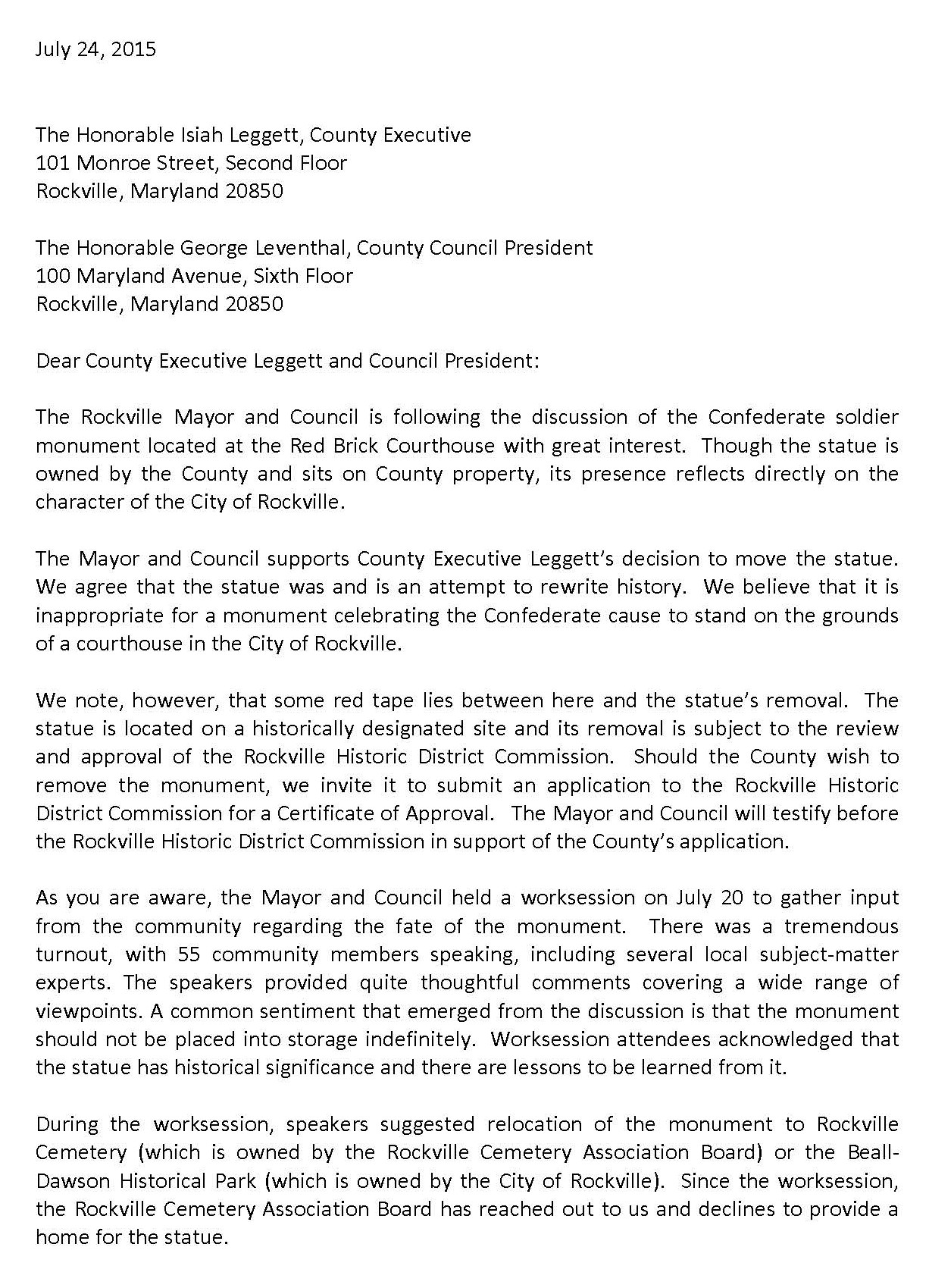

First, Jawando and Palakovich Carr justify their bills partly “in order to pay for the increased local share of education funding required under the Kirwan Commission.” Counties around the state are concerned about how they might pay for any additional local obligations to schools stemming from the Kirwan Commission’s recommendations. Those obligations are laid out in Appendix F of the Kirwan Commission bill’s fiscal note, which is reprinted below.

A careful look at the phase-in schedule shows that Montgomery County is not currently required to contribute any more to its public schools than it already has been doing until Fiscal Year 2027, which is MORE THAN SIX YEARS AWAY. Why are these elected officials pushing tax hikes now? One struggles to see how this is linked in any way to Kirwan.

Furthermore, even in years in which no tax hikes are levied, the Montgomery County government gets an average of more than $100 million in new revenue a year, and that excludes intergovernmental aid. If the phase-in schedule above were altered to allow a more gradual phase-in for the county’s local obligations – say, $25-30 million a year instead of cramming it all into four years – the county might not have to raise taxes at all. The county might have to restrain spending in other areas to allocate greater shares of new revenue to MCPS, but that would make up for the fact that local money for MCPS has been one of the slowest growing parts of the county budget for a decade.

Second, this plays directly into Ficker’s hands. There was a time not so long ago when Ficker’s name was so radioactive due to his NBA heckling and his rampant placement of illegal campaign signs that his very association with a ballot question was enough to kill it. Those days are gone. In 2008, the county raised property taxes by 13%. Voters responded months later by passing Ficker’s charter amendment requiring that nine county council members must vote in favor of any property tax increase breaking the county’s charter limit. In 2016, the county raised property taxes by 8.7%. Voters responded by passing Ficker’s charter amendment on term limits by a landslide. Now, counting the bills supported by Jawando and Palakovich Carr as well as a separate bill by Council Member Evan Glass calling for new taxes on teardowns, there are three different bills pending that allow county tax increases just as Ficker is pushing for a new anti-tax charter amendment.

Ficker must be the happiest man in MoCo.

Ficker does not win passage of his charter amendments because voters love him. He has run in almost every four-year election cycle since the 1970s, with just one victory (a 1978 Delegate race) that was reversed after a single term. He has not come close to being elected since. Ficker wins because he has deduced something that county politicians hate to admit, at least in public: voters are skeptical that our elected officials are capable of behaving responsibly with their tax dollars. Indeed, the county has levied nine major tax hikes since Fiscal Year 2003, with only one (an energy tax increase in Fiscal Year 2011) occurring during a recession. The most recent tax hike, the 8.7% property tax increase in 2016, was marketed in part as a way to close MCPS’s achievement gap. Three years later, the council’s Office of Legislative Oversight found that the county has made little or no progress on the achievement gap despite the massive tax hike.

This kind of thing is why Ficker wins.

Let’s think of what is at stake. In 1978, Prince George’s County passed an anti-tax charter amendment only a little more draconian than Ficker’s. Five years later, in the wake of the devastating recession of the early 1980s and lacking an ability to raise taxes, the county had to gut services and lay off more than 500 teachers, laying the groundwork for decades of problems. Heaven help MoCo if we proceed in that direction.

If MoCo’s elected officials want to avoid that sort of outcome, they need to behave responsibly. Save the tax hikes for times of desperate need, like recessions. The rest of the time, figure out how to live within your means just like your constituents do. Above all, stop giving ammo to Ficker.

The alternative? Picture this. Ficker celebrates in November, bellowing in victory at the passage of yet another charter amendment. And the county government, struggling in fiscal chains strung up by distrustful voters, becomes more vulnerable to the next recession.