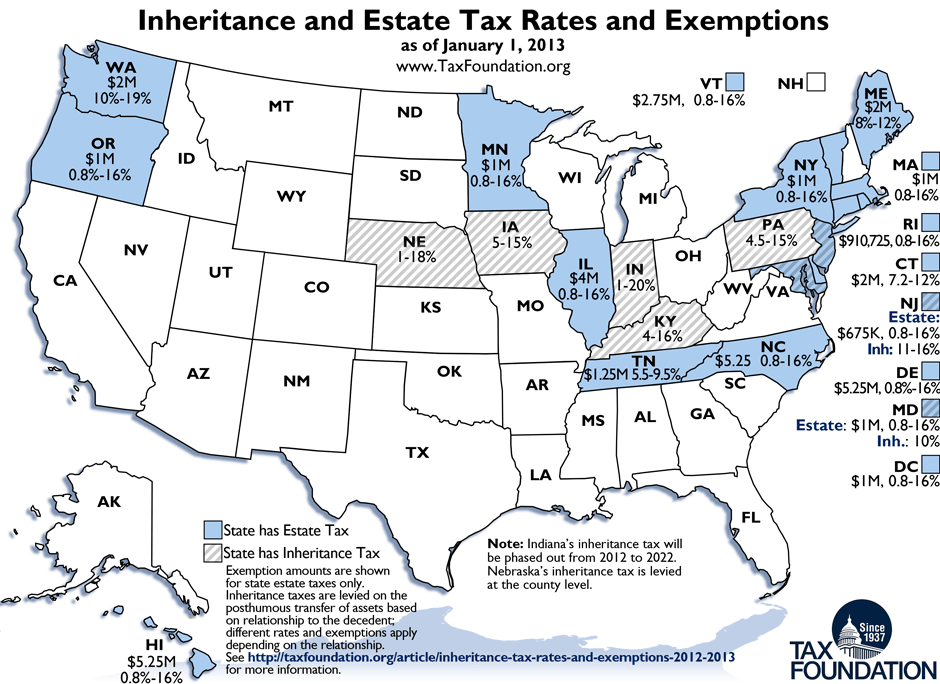

Much ado has been made of the necessity of cutting inheritance taxes in Maryland in order to avoid driving away wealthy people from Maryland looking to leave their assets unencumbered by state taxes. Sounds like a reasonable theory. And it’s a priority of Senate President Mike Miller and House Speaker Mike Busch.

Except that there is only anecdotal rather than systematic evidence that these specific taxes actually drive people away. The more thorough analyses indicate little impact. In any case, it’s not clear that even if it were so, that the changes will accomplish the goal, as other states have no inheritance taxes at all.

Since revenue estimates keep declining, it’s not at all clear that tax cuts are advisable at all at this time. If we’re not careful, the State may end up having difficulty paying its bills. Alternatively, the General Assembly would need to identify spending cuts to match the tax cuts. After all, tax cuts are another form of expenditure.

If the State desires to cut taxes, there is a better way. Instead of cutting a tax that does designed to accomplish the illusory problem of preventing wealthy taxpayers from fleeing the State, let’s simply raise the minimum amount on which state income taxes are paid.

This alternative has many virtues. First, it puts more money directly in the pocket of ordinary people who need the money and whose incomes have stagnated for some years. Second, people with less money are more likely to spend it and stimulate the economy.

As it turns out, lots of poor, working, and middle-class people can generate jobs just fine with their spending power. Contrary to propaganda that only the rich are job creators, basic economic theory says that everyone generates jobs through their consumption and savings (i.e. investment).

Finally, this sort of tax cut benefits everyone who pays taxes. The wealthy get a sum too–the same amount as most who pay taxes. It nonetheless remains a smaller amount of their income. A fairer way to reduce the burden on all of the people who are bear it rather than a select few who don’t need a break. More crucially, there is no solid evidence that doing so will aid our State’s economy.