The General Assembly managed to pass a tax subsidy worth $37.5 million for Northrup Grumman but not to enact the increase in the Earned Income Tax Credit (EIRC) that both houses favor. Laudably, the House did not tie the EITC increase to a tax cut for the wealthy like the Senate but instead adopted a broad based tax cut.

Nonetheless, the corporate welfare for Northrup Grumman easily passed the House of Delegates 76-57. Twenty-eight House Democrats supported this giveaway, including several who identify themselves as progressive leaders in the House:

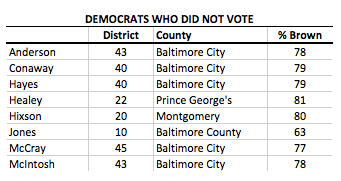

Eight Democrats didn’t vote on the issue, including a few members of the House leadership team:

Eight Democrats didn’t vote on the issue, including a few members of the House leadership team:

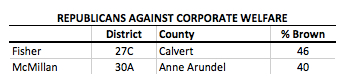

Two Republicans stood for conservative principles and did not give away your tax dollars to a corporation that already does quite well at the federal trough.