On a 7-2 vote, the Montgomery County Council approved a bill that would completely exempt real estate developments on WMATA property from property taxes for 15 years. Councilmembers Tom Hucker and Will Jawando voted against. The Council should sustain County Executive Marc Elrich’s veto of this corporate welfare masked as a social justice housing project.

This bill is such a bad idea that one hardly knows where to begin.

Proponents of transit endlessly sell the considerable funding required for it as the motor for development and smart growth that not only attracts jobs but increases land values and property tax revenues. We are told “if you build it, they will come.” Now, these same people tell us that they won’t come unless we “incentivize” (read: pay) them.

Even stranger, we are to pay these incentives to build high-priced apartments in desirable locations with very little extra affordable housing thrown in above normal requirements. I understand establishing enterprise zones with lower taxes in struggling neighborhoods, but Grosvenor-Strathmore and other Red Line stops don’t fit the bill.

Councilmember Andrew Friedson (D-1) has been quite aggressive in trying to sell Councilmember Hans Riemer’s bill:

None of the WMATA sites are being developed and developers with Joint Development Agreements are walking away all over the region, due to unique infrastructure requirements on these sites, high costs of high-rise construction, etc.

These sites currently collect ZERO property tax, generate ZERO housing, and provide virtually no public benefits aside from surface parking. I view that as an abject public failure, but respect anyone who prefers this status quo.

Multiple fiscal analyses have demonstrated both that high-rise projects don’t work without the incentive and that the Grosvenor project in particular would generate more revenue to the County in impact and income taxes than the property tax abatement (which the county wouldn’t otherwise receive without a project).

Councilmember Friedson argues we need to step up our corporate welfare game to compete when we shouldn’t even play this game. His argument also ignores that demand for homes in Frederick or Fairfax is based on other factors that far outweigh tax incentives linked to individual projects.

The uniqueness of the site argument fails to impress as somehow many buildings have been constructed around the whole region, indeed the whole country, around transit and difficult sites without the magic of tax incentives. (Manhattan exists!) I’m sure WMATA, developers and their supporters on the Council are happy to produce analyses showing otherwise, just as they always have in support of public spending on their agenda.

The incentives are a roundabout subsidy to WMATA. When we establish tax incentives the land becomes more valuable, so WMATA raises the price and recoups much of it. So it’s not even clear what share of this supposedly badly needed incentive the developers will see.

This tax giveaway also won’t increase the housing stock. When it’s built, Councilmembers Riemer and Friedson will point to it and say, “look what we did!” Except there will be another nearby project that didn’t happen because you’ve already pre-satisfied any demand with this one. Montgomery has plenty of land zoned for housing and buildings.

Councilmember Friedson also neglects to mention that the building will not have a zero cost to the county. Providing county services will cost money but Montgomery will receive a lot less than normal to cover those costs.

Andrew Friedson has been touted with much hope, including here, as the Council’s bright new economic light. If he wants to live up to this promise, he needs to shift his focus fast from this old-style ineffective developer welfare to more original ideas to attract commercial business to Montgomery.

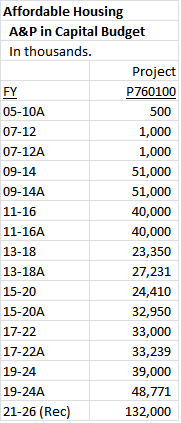

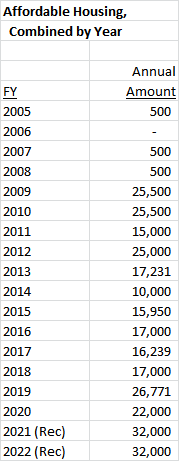

The bill reflects Councilmember Hans Riemer’s long-term approach over several terms to housing, which has long dominated the Council. Unfortunately, it has had far more success in pleasing monied interests than it has accomplished in producing affordable housing. No doubt it also pleases David Blair’s developer-heavy crowd.

Councilmember Nancy Navarro has presented herself as second to none as a champion for social justice. She has stood up unflinchingly for often abused undocumented immigrants to the frequent dismay of their opponents around the State. Here, she argued that the Council needed to “be bold” and support this bill.

Except there is nothing remotely new, let alone bold, about giving a tax subsidy to developers. Speeding the production of high-priced apartments strikes me as the opposite of social justice.

I cannot help but wonder why this proudly progressive Council is focused on this legislation at this time when so many county residents are facing far more immediate and desperate problems. Even managing the day to day is still far from ordinary.

Charter Amendment A on Property Taxes

The crowning insult of this legislation is its juxtaposition with County Charter Amendment A. The short version is that the Council majority is now proposing to collect more in property taxes from ordinary residents even as it engages in this tax giveaway that has no valid economic or public purpose.

Charter Amendment A garners support from many because the current property tax system is not ideal for a variety of reasons (not the subject of this post). It effectively asks voters to loosen the very tight tax corset (it can only rise with the rate of inflation) so that the county can collect more if property values rise, as would likely happen now if the measure passes. It’s a tough ask at a time when many have seen incomes drop. One can argue that it is necessary when so many are in need.

But it is insupportable for the majority of the Montgomery County Council to offer a tax holiday to developers while increasing the take from ordinary citizens. It’s not progressive. It’s not liberal. It’s just bad economic policy wrapped in gaudy rhetoric that doesn’t stand up to scrutiny. It goes against this county’s good government traditions.

County Executive Elrich was right to veto this bad bill. The Council should vote to uphold his veto tomorrow.