By Adam Pagnucco.

In 2014, candidate Larry Hogan ran on three issues: jobs, taxes and reforming Annapolis. From 2015 through the present, Governor Larry Hogan has based his agenda on three issues: jobs, taxes and reforming Annapolis. It’s a smart and focused way to campaign and govern and has largely (although perhaps temporarily) neutralized Hogan’s disadvantage as a Republican in blue Maryland. But now the state budget is suffering from a revenue shortfall. That calls into question Hogan’s standing on perhaps his biggest issue: jobs.

Recent polls show that jobs and the economy are the second most important issue for Marylanders, trailing only public education. Accordingly, Hogan relentlessly promotes his jobs record in the press and social media, not so subtly using it as justification for his reelection. But if employment was really surging, state revenues should be booming. They’re not.

One of countless Facebook posts by the Governor on jobs.

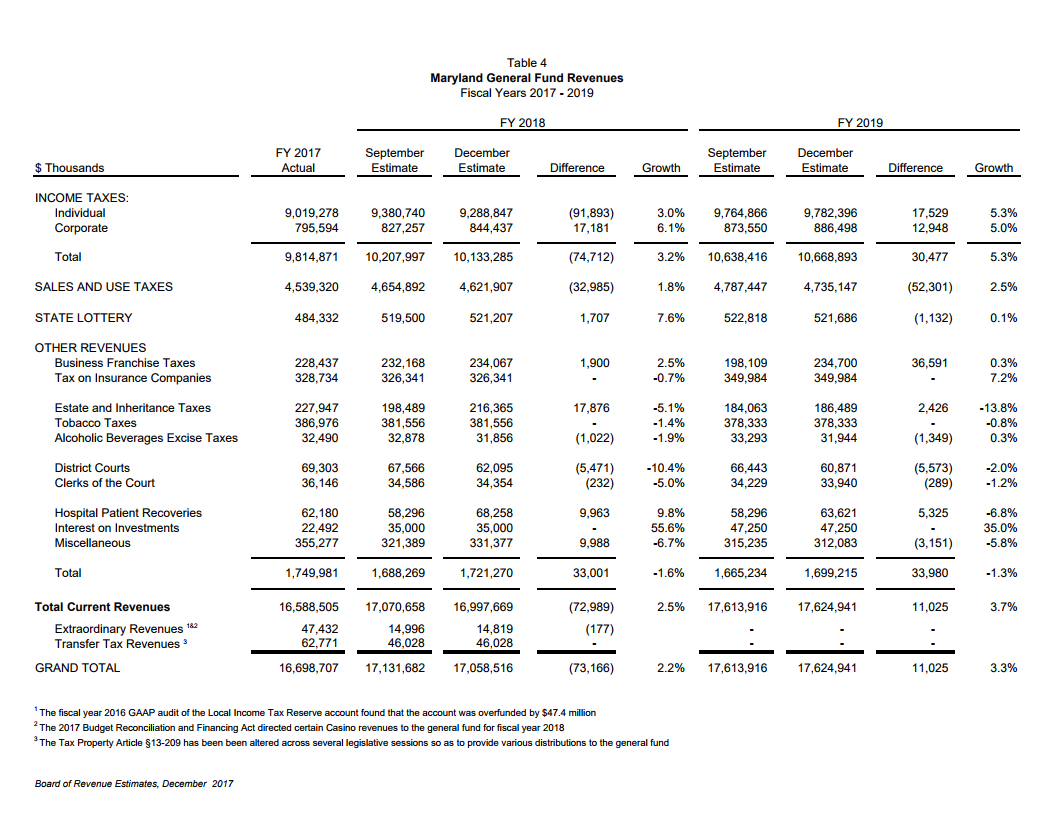

Last week, the Board of Revenue Estimates, comprised of the Comptroller, the Treasurer and the Secretary of Budget and Management, voted to reduce the state’s revenue projection for FY18 (the current fiscal year) by $73 million. The reduction included shortfalls of $92 million in income taxes and $33 million in sales and use taxes, which were partially offset by increases of $18 million in estate taxes and $17 million in corporate income taxes.

A summary of the shortfall released by the Board of Revenue Estimates.

Given the fact that the November income tax distributions were down by 26% in Baltimore County, 29% in Montgomery County and 30% in Howard County, it’s not surprising that the state’s income tax projections would take a hit. In those three counties, tax planning by the wealthy to take advantage of next year’s federal tax cuts was probably a factor in their shortfalls. The fact that Maryland has the highest percentage of millionaire households of any state in the country leaves it vulnerable to these kinds of revenue swings.

But that’s not all. The $33 million decline in projected sales and use taxes does not relate to tax planning by the rich. That’s a similar situation to what MoCo is experiencing as half the county’s shortfall comes from taxes other than income taxes. Hogan is dealing with the same problem as MoCo’s county elected officials: for all their claims that the economy is strong, healthy economies tend to not produce significant revenue shortfalls. Recent employment estimates are often revised substantially soon after their release, but current year revenue declines are something that governments have to deal with in the near term.

Here’s what Comptroller Peter Franchot had to say about the state’s falling revenue projections:

The revenue projections that have been brought to this Board for approval were meticulously and carefully crafted based on what we know … and the trends we are seeing … and the data we are receiving. Once Congress approves a final version of the tax reform legislation, our experts here will work diligently to determine its impact on Marylanders’ income and our state’s fiscal future and propose revisions to our revenue estimates where appropriate.

In other words, we’re doing the best we can with the information we have. But, here’s what we do know and here’s what the numbers tell us. While we have undoubtedly made considerable progress after the crippling effects of the 2008 Recession, with an unemployment rate hovering around 4 percent and stock market trends that are headed in the right direction, the fact of the matter is that thousands of Maryland working families and small business owners who were affected the most by the economic crash nearly a decade ago haven’t fully recovered.

We continue to see that with declining sales and use tax revenue. With wages and salaries that are lackluster at best. Even those who are employed with good-paying jobs have – in more cases than not – elected to put their disposable incomes in their piggy banks instead of putting money back in our local economy. And who can blame them?

With all the uncertainty that’s being produced by Washington at an almost daily basis, coupled with the continued fiscal and economic challenges that our state and our communities face, it’s understandable why so many of our citizens remain hesitant and timid about how they spend their hard-earned incomes.

Let’s remember that Franchot has a famously cooperative relationship with Hogan. Even so, Franchot is saying that the state’s economy has not fully recovered from the Great Recession – which is exactly what we wrote about MoCo before the revenue crash.

This is the opposite of Larry Hogan’s message that he has been great on jobs. His opponents are sure to take notice.