By Adam Pagnucco.

Anti-immigration group Help Save Maryland (HSM) has a political agenda which it characterizes as “Working to make our elected officials accountable to the citizens of Maryland.” More specifically, the group seeks to make the State of Maryland inhospitable to illegal immigrants through influencing a variety of public policy decisions. HSM, like any other group, has a First Amendment right to express its political views. But it also claims a tax-exempt status with the federal Internal Revenue Service and that could be a problem.

Non-profit organizations may file with the Internal Revenue Service (IRS) to obtain tax-exempt status. One such category is governed by section 501(c)(3) of the Internal Revenue Code, which allows non-profit organizations (and contributions to them) to be exempt from federal taxes if they are organized for one or more of the following purposes: religious, charitable, scientific, testing for public safety, literary, educational, fostering amateur sports competition and the prevention of cruelty to children or animals.

HSM states on its website:

Help Save Maryland.org is a multi-ethnic, grass roots, citizens’ organization with members state-wide. As a volunteer, nonprofit 501(c) 3, we accept donations (tax-deductible) to help defray our costs. Let’s work together through outreach and other activities to educate fellow Marylanders regarding the financial, social and economic costs of illegal immigration. Please donate by credit card online or postal mail your tax deductible donation to:

Help Save Maryland

PO Box 5742

Rockville, MD 20855

In return for being exempt from federal taxes, the IRS imposes restrictions on political activities that may be undertaken by 501(c)(3) non-profits. The first is an absolute prohibition on advocating for or against candidates in elections. The IRS states:

Under the Internal Revenue Code, all section 501(c)(3) organizations are absolutely prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office. Contributions to political campaign funds or public statements of position (verbal or written) made on behalf of the organization in favor of or in opposition to any candidate for public office clearly violate the prohibition against political campaign activity. Violating this prohibition may result in denial or revocation of tax-exempt status and the imposition of certain excise taxes.

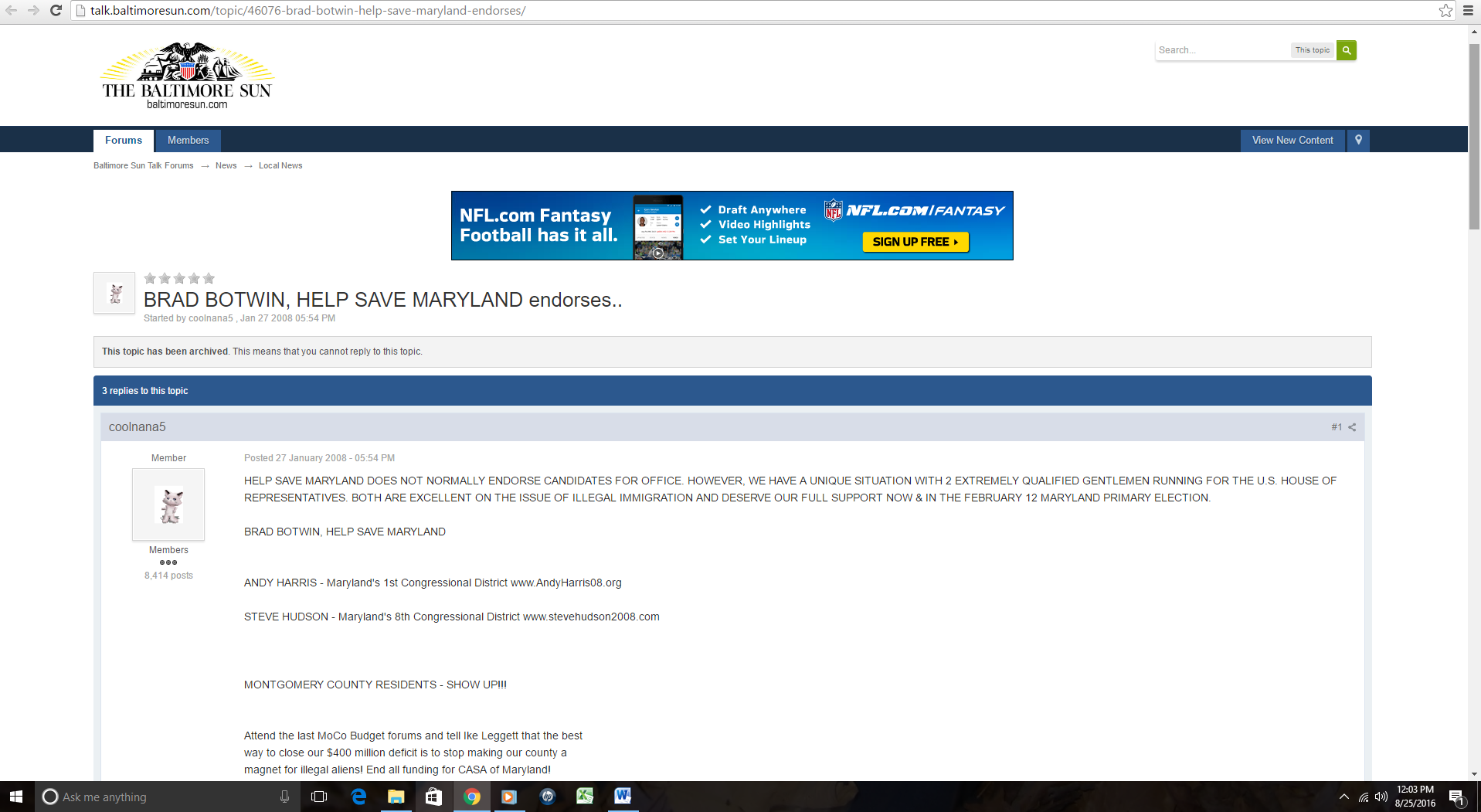

HSM has broken this rule at least three times. In January 2008, the organization formally endorsed GOP candidates Andy Harris (CD1) and Steve Hudson (CD8) for Congress. In May 2009, HSM advocated for the defeat of Nancy Navarro in the 2009 Council District 4 special election. In an email to its supporters, HSM stated plainly, “We need your help this Saturday and Sunday May 2 & 3 in Montgomery County. HSM is fighting the election of Democratic Candidate Nancy Navarro for County Council in a District 4 special election scheduled for May 19.” The group called for volunteers to help defeat Navarro. And in June 2009, HSM openly called for the defeat of four state legislators for allegedly supporting illegal immigrants: Senator Jennie Forehand (D-17) and Delegates Ana Sol Gutierrez (D-18), Sheila Hixson (D-20) and Saqib Ali (D-39).

Help Save Maryland makes endorsements for Congress.

Organizations with 501(c)(3) status are allowed to engage in other forms of political activity, but restrictions apply. On the topic of lobbying by 501(c)(3) groups, the IRS says this:

In general, if a substantial part of the activities of your organization consists of carrying on propaganda or otherwise attempting to influence legislation, your organization’s exemption from federal income tax will be denied. However, a public charity (other than a church, an integrated auxiliary of a church or of a convention or association of churches, or a member of an affiliated group of organizations that includes a church, etc.) may avoid this result. Such a charity can elect to replace the substantial part of activities test with a limit defined in terms of expenditures for influencing legislation. Private foundations cannot make this election.

A general question for the reader. Check out HSM’s website. Do you see anything OTHER than propaganda there??

Let’s go back to the IRS. The agency defines “attempting to influence legislation” as:

- Any attempt to influence any legislation through an effort to affect the opinions of the general public or any segment thereof (grass roots lobbying), and

- Any attempt to influence any legislation through communication with any member or employee of a legislative body or with any government official or employee who may participate in the formulation of legislation (direct lobbying).

There are exceptions, including “making available the results of nonpartisan analysis, study, or research” and “examining and discussing broad social, economic, and similar problems.” HSM no doubt would claim that its activities fall within these areas. But take a look at content like this attack on Gold Star father Khizr Khan as a “Muslim Brotherhood agent who wants to advance sharia law” and decide for yourself if this qualifies.

The IRS’s monetary limits on allowable lobbying expenditures, including “grass roots expenditures” intended to “affect the opinions of the general public or any segment thereof,” are complicated. For small non-profits with limited resources, a key rule is “the lobbying nontaxable amount for any organization for any tax year is the lesser of $1,000,000 or 20% of the exempt purpose expenditures if the exempt purpose expenditures are not over $500,000,” with different limits for larger organizations. Clearly, any organization that spends most of its resources on lobbying, including grass roots activities to affect public opinion, would have problems complying with this provision. HSM’s gathering of signatures for Robin Ficker’s term limits amendment, its email on the petition’s behalf and its defense of Donald Trump are definitely intended to “affect the opinions of the general public.” And more broadly, an individual perusing HSM’s website and blog would have difficulty spotting content that is NOT political in nature.

Help Save Maryland has every right to express political opinions. That’s not the issue here. But it does not have a right to engage in little other than political activity while being exempt from federal taxes and collecting tax-exempt contributions. Your author is no tax lawyer, but from the facts presented above, it seems possible that Help Save Maryland’s activities may run afoul of the IRS’s 501(c)(3) rules.