By Adam Pagnucco.

In the wake of his veto message, County Executive Marc Elrich has once again blasted a bill passed by the county council granting developers at Metro stations 15-year property tax breaks. The council is set to override Elrich’s veto on Tuesday. Elrich’s mass email, which reiterates his reasons for vetoing the bill, is reprinted below.

*****

Dear Friends:

Last week I issued my first veto of legislation, Bill 29-20 Taxation – Payment in Lieu of Taxes – WMATA Property. I sent a memorandum with the veto explaining in detail the reasons for the veto; you can read the entire memo here, but I wanted to explain some of the reasons in my letter.

Like the Council, I am focused on expanding transit and transit-oriented development, broadening our tax base and preserving and increasing the supply of affordable housing. Unfortunately, Bill 29-20 does not achieve any important goals, is too costly and does not produce sufficient public benefit to justify the cost.

This legislation would require 100 percent exemption of the real property tax for 15 years. This exemption is known as a Payment in Lieu of Taxes, or PILOT [see NOTE 1]. A few requirements are included in the bill. However, it would not increase the number of affordable housing units than otherwise would have been provided. While it was amended to make some of the units more affordable, we could have negotiated that with the developer at a fraction of the cost to the County.

[NOTE 1: The requirement applies to development that is higher than eight stories on property owned by WMATA at a Metro station. The development must include at least 50 percent residential rental housing, and one-quarter of the moderately priced dwelling units (MPDUs) must be affordable for residents at 50 percent of area median income (AMI). The PILOT would begin no later than the second year after the property tax is levied. The law would sunset in 2032, but any existing PILOT would continue until the end of its 15-year period. To be eligible for a PILOT, a developer would be required to use contractors and subcontractors who have no more than two final penalties of $5,000 or more in the three prior years for violations of applicable wage and hour laws. At least 25 percent of the workers constructing the project must be County residents. Special taxing district taxes are exempt from the PILOT.]

It is an expensive, and unnecessary, approach, particularly at this moment when the County is struggling to fund critical services (the need for which is increasing and will likely continue to increase for a while), where the outlook for revenues over the next couple of years is not good and where full economic recovery from this pandemic may take as much as 10 years. It is certainly not prudent to reduce revenues coming into the County coffers at this time.

During the Council’s deliberations on the bill, supporters could only cite one potential development as being eligible for this 15-year, 100 percent tax break – the proposed Strathmore Square at the Grosvenor/Strathmore Station. Under the provisions of this legislation, Strathmore Square’s owners would receive a tax break of approximately $100 million. As a member of the County Council, I supported the zoning changes that made this proposed development possible, but I simply do not believe it is a responsible use of County resources to supplement a market-rate housing complex at this level of expense.

The developer of that project saw an increase in the allowed units that went from a little over 500 to more than 2,200—density that was based on being atop a Metro station. Now, the developer is arguing that it is too expensive to develop on the Metro, yet WMATA records show that the price the developer paid was based on an appraisal that was done AFTER the property was rezoned. The developer accepted the appraisal and agreed to proceed. If the developer thought the price was unreasonable and would make development unprofitable, it could have rejected the appraisal and the deal. Instead, it came to the County three years later and asked that all its taxes be forgiven because the deal does not work for it.

Should similar developments occur at the other potential WMATA sites across the County, lost revenue would likely exceed $400 million. To be clear, I want more housing constructed in our County, and I see the significant benefit of housing that makes transit usage extremely convenient. However, I do not believe providing developers with as much as $400 million in incentives is necessary to get 8,000 new housing units that are projected to come here anyway. Put another way, this bill would provide a developer with a $50,000 per unit gift regardless of cost of rent, without producing additional affordable housing units beyond the amount required for all developments. This is not a good use of public funds.

Nor do we need this law—the authority already exists for the County to negotiate individual agreements.

It makes sense to continue to allow them on a project-by-project basis—not all projects need the same PILOT term or value. Flexibility should be maintained to enable negotiation of the best possible agreement that is in the public interest.

Additionally, it does not make sense to focus the market rate housing (along with the public subsidy) at Metro stations, which pushes affordable housing elsewhere. As the recent Housing Preservation study points out, affordable housing units near transit are at greatest risk of being lost and are being lost. Seventy-five percent of projected need for housing over the next decade is for affordable housing—why would the focus of a housing bill be on subsidizing market rate housing? Furthermore, given the projected number of market units needed over the next 20 years, there is sufficient zoning near Metro Stations to accommodate the needed units. While they might not be built on top of Metro property, they may be built nearby within easy walking distance of the Metro.

In White Flint, there are properties adjacent to, and across the street from, the Metro entrance where housing could be built that would actually be closer to the Metro entrance than some buildings on WMATA property. In other words, the housing does not have to be built directly on WMATA property; it can be nearby. And this bill creates a difficult precedent. It is likely that other properties near Metro will ask for the same PILOT. Those properties offer similar value in providing transit proximate development. It is simply not good policy to have a general approach to subsidize market rate housing.

Ironically, this bill may be counterproductive by raising the value of WMATA’s land. Under Federal law, WMATA must seek the highest and best price for its land. Land that is exempted from all property taxes for 15 years is more valuable because the calculation of its value includes the costs to acquire and develop, including taxes, weighed against market rents. If two properties are side by side, one exempt from taxes and the other not, and they were producing the same value of unit, the land value of the exempt property would be greater because its cost of development would be less than the cost to develop the tax-paying property. This would, in turn, likely raise the parcel’s appraised value. Supporters of the bill have said they are trying to reduce the cost to developers, but if the value of the land increases, the bill has had the opposite effect.

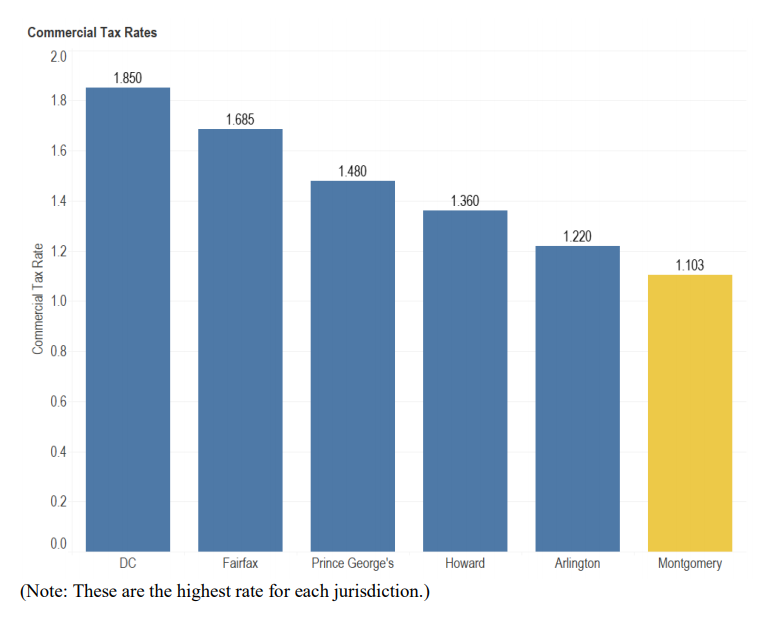

Furthermore, there is no evidence that this is needed. In fact, if you look around the region, many of our neighboring jurisdictions have their highest taxes on property nearest Metro sites and the tax rates are substantially greater than in Montgomery County. If property taxes were the key to development, we would have won the development battle a long time ago because we are lower than most surrounding jurisdictions. (See chart below)

And I would note that if one of the goals of this bill is to provide tax incentives to attract new businesses, those incentives should go to the occupant of the building, not to the developer of the building. This legislation gives public funds to help build buildings, not to incentivize businesses to become tenants in those buildings.

And workers deserve a prevailing wage. A majority of the Council voted against requiring the prevailing wage at these projects. The provision would have required that all contractors and subcontractors pay prevailing wages and be licensed, bonded, insured and abide by wage and hour laws. Legislation that dedicates public funds to market-rate housing should, at least, also support the workers who build the housing. If WMATA was building a structure on the same property, current law would require it to abide by the prevailing wage. I believe the developments contemplated by this bill should as well. The lack of such a provision to treat workers equitably and to share in the subsidy is another major deficiency in this legislation.

Finally, to risk of stating the obvious, using our limited funds for market-rate (non-affordable) housing development means fewer funds for other services including affordable housing, recreation and education, which has a racial equity/social justice impact. This bill allows housing to be built for those who can afford it, not for lower-income populations who are disproportionately Black and Latino.

I hope this gives you a better understanding why I could not support this bill.

Sincerely,

Marc Elrich

County Executive