By Adam Pagnucco.

MoCo voters will see two charter amendments on property taxes on their ballots this fall. One of them was submitted by long-time anti-tax activist Robin Ficker, who delivered his petition signatures in February. The other was authored by Council Member Andrew Friedson and placed on the ballot by the county council. The Washington Post editorial board dislikes both, but for progressives, the choice is clear: the Friedson amendment is superior in providing adequate funding for government.

The first reason why progressives should support the Friedson amendment over the Ficker amendment is due to the nature of how they allow revenue increases. The Ficker amendment uses the methodology of the current charter limit on property taxes, which dates back to 1990. Currently, MoCo’s charter allows the volume of real property tax collections to rise at the rate of inflation with a few relatively minor exceptions. Friedson’s charter amendment would cap the weighted average tax rate on real property and allow collections to rise with assessments. So to compare their revenue generation over time, we need to compare the growth in price inflation (which is relied upon by the Ficker amendment) to the growth in assessments (which is relied upon by the Friedson amendment).

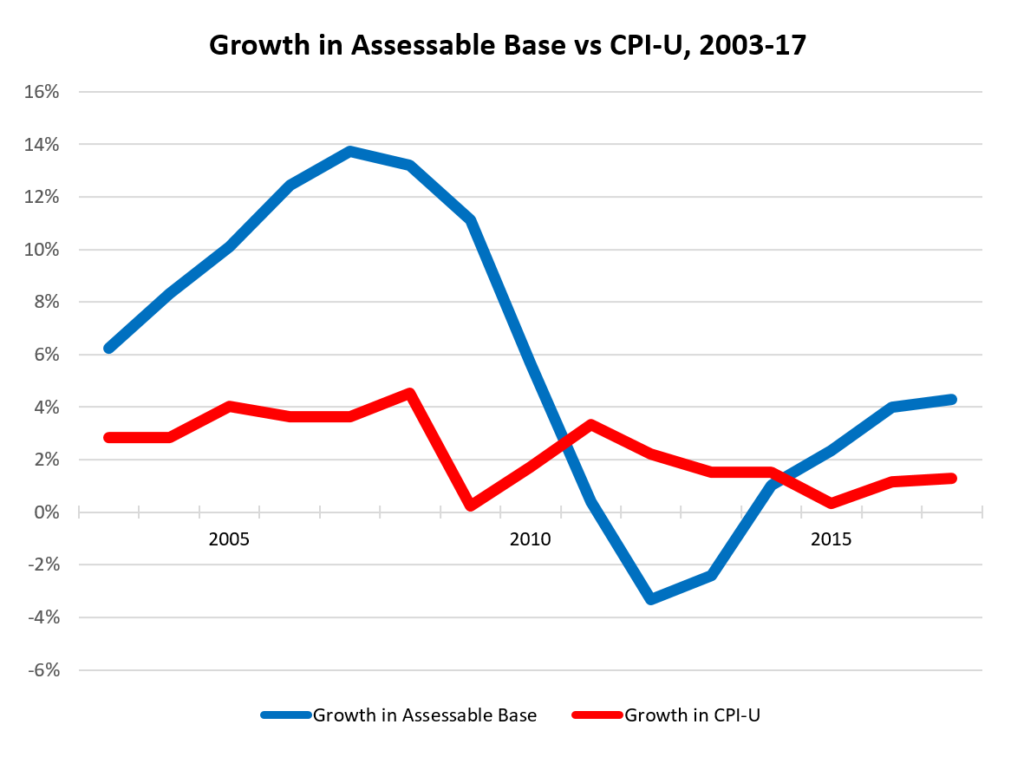

The chart below compares the growth in the county’s assessed value of real property to the growth in the Washington-Baltimore Consumer Price Index (CPI) from 2003 through 2017.

This period contained three distinct economic phases. The 2003-2010 period saw robust economic growth throughout the Washington region, causing assessment growth (115%) to far outpace price inflation (26%). Then came the Great Recession years of 2010 to 2013, during which assessments fell (5% over three years) while prices rose modestly (7%). In the slow recovery through 2017, assessments went up by 12% while prices rose by 4%. For the entire period, assessments increased by 129% while price inflation was 41%, suggesting that Friedson’s approach would have yielded MUCH more property tax revenue growth than Ficker’s. (The exact difference would have depended on other factors such as the application of tax credits, especially the homestead tax credit.)

That said, in four of these sixteen years – the period of the Great Recession – Ficker’s approach would have raised more than Friedson’s because real estate values tend to decline during prolonged economic downturns. That leads us to the second major difference between the Friedson and Ficker amendments. Friedson’s amendment allows a unanimous council vote to break the charter limit on property taxes, which continues current practice. Ficker’s amendment eliminates the ability of the council to break the limit, thereby instituting a hard cap on property tax collections. (There is an important exception to this in state law which will be the subject of a future post.) If property tax collections collapse during a recession, Friedson would allow the council to intervene in case of an emergency while Ficker would not. That’s another big reason why progressives should support the Friedson amendment.

Some progressives were disappointed because they wanted the council to adopt County Executive Marc Elrich’s proposed charter amendment, which would have made property tax hikes easier. Good luck getting MoCo voters whose wallets are getting slammed by COVID-19 to support anything opening the door to tax hikes. The Friedson and Ficker amendments both limit property tax increases, but since the Friedson amendment raises more money over time, it deserves the support of the left.

Update: An earlier version of this post was based on changes in the national CPI. This version is based on the Washington-Baltimore CPI. The two measures change at similar rates so the conclusions here are unaffected.