By Adam Pagnucco.

Maryland’s two teachers unions – the Maryland State Education Association and the Baltimore Teachers Union – have signed a joint letter with the Maryland PTA to Governor Larry Hogan and the state superintendent of schools requesting that the next school year begin with virtual learning for at least the first semester. The joint letter is reprinted below.

*****

Dear Governor Hogan and Superintendent Salmon:

Maryland’s educators and students are eager to return to our classrooms and schools. Educators miss their students, and students miss their teachers and friends. We all miss our school communities, especially as we have come together in incredible ways during the challenging months of this pandemic. Additionally, we know that the inequities facing our Black and Brown students have deepened and widened during the pandemic. There is much work to do to make up for the learning that has been lost and to address the trauma experienced by so many in our school communities.

While we are eager to return to school, we are not blind to the challenges of doing so during this pandemic. Any return to in-person learning must prioritize and guarantee the highest standards for health and safety. Any return must be guided by science and the expertise of educators. Any return to in-person learning also must have renewed commitments to funding and supports so schools are not just ready to open on the first day of school but are safe places to learn and work for the entire school year.

As states have reopened parts of their economies, we have seen infection rates climb. While Maryland has thankfully not experienced the recent spike that other states have, the virus remains an ever-present threat and impediment to normalcy. Maryland is still in a declared state of emergency and the reopening of limited services has rightfully been done with caution. It should not be lost on anyone that physically reopening schools would be, by several orders of magnitude, a much more ambitious—and dangerous—undertaking than any other reopening step we have taken thus far. We are all familiar with the risks:

• bringing together high numbers of people in enclosed, inconsistently ventilated, indoor spaces for hours at a time;

• the significant numbers of educators who are particularly susceptible to the virus (24% of all teachers according to a July 10 Kaiser Family Foundation analysis);

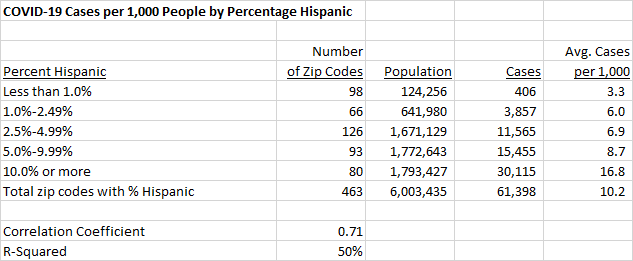

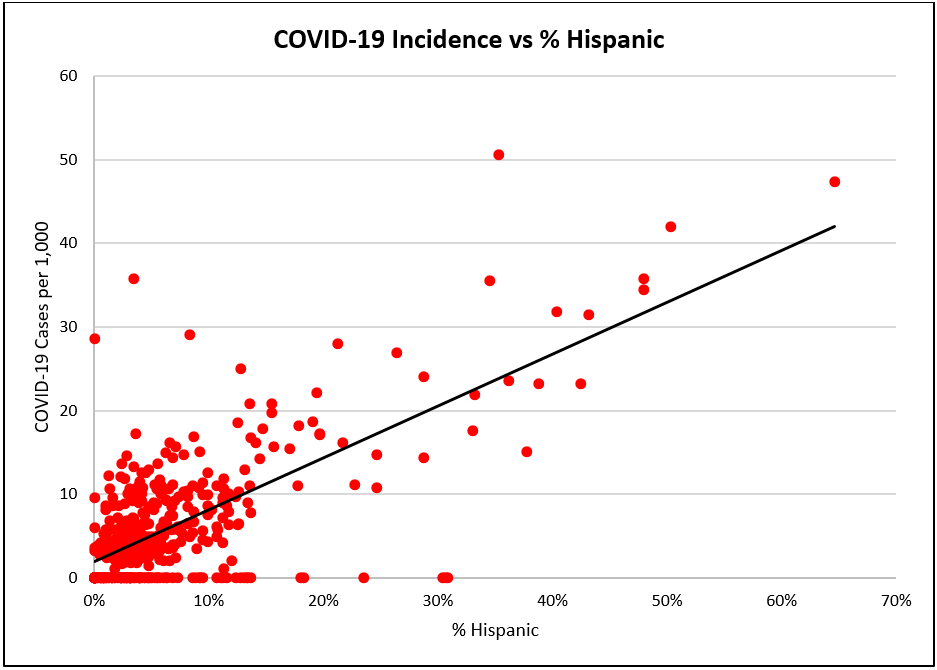

• the significant numbers of Black and Brown students (who make up more than 50% of our student body statewide) and their families who unjustly face healthcare disparities that have made them more likely to be infected and killed by the coronavirus; these students also disproportionately rely on public transportation to get to school, compounding risk before arriving at school facilities that may lack necessary ventilation and a safe learning environment;

• the lack of widely available personal protective equipment (PPE) and testing for educators and students;

• the challenges in ensuring that all students and staff are wearing masks, washing hands, and maintaining social distance at all times; and,

• so much that we do not know or understand about the virus and that is seemingly constantly updated by new scientific studies.

For these reasons and more, we are calling for the 2020-2021 school year to begin with virtual learning and instruction for at least the first semester. Protecting the safety of Maryland educators, students, and families requires this action. We believe it is the right approach and will allow time for further evaluation of health matrices, stakeholder input, and the educational needs of students on a district-by-district basis to allow for a transition to a hybrid learning model after the year begins and possibly a mostly in-person model later in the school year if and when it is safe.

Making this decision now would give every district at least a full six weeks to plan and troubleshoot around one known and understood model of learning. Exceptions to this should be possible only in districts with the very lowest levels of infection and community spread, and with the strong educator and family support necessary in those jurisdictions. Provided they are able to do so at the highest levels of safety, districts should explore whether a limited hybrid model with very small groups of students is feasible with limited student populations for whom equity concerns around extended virtual learning are greatest. Educators who feel comfortable working with these students or working in school buildings should be able to do so.

When districts can have a laser focus on one model, they can better concentrate their resources and work with educators and stakeholders to be successful with virtual learning for all students. This reopening model would allow districts to resolve the inequities of the digital divide that were laid bare this spring. Additionally, focusing on a completely virtual model would allow districts to be better prepared if the state must reverse course and move back into Phase I or a complete quarantine again at some point during the school year.

We agree with Governor Hogan that we will not be bullied by political pressure from Washington, DC. We will not succumb to politics that would place Maryland educators, students, or families in harm’s way and have them participate in a potentially deadly experiment. There is an inhuman callousness that attempts to use the lower transmission rates and mortality rates for people under the age of 18 as justification for reopening schools. Not only does this completely ignore the adults in schools who would undoubtedly have a higher rate of transmission and death, but it also presupposes that there is a number of deaths of students and educators that is acceptable. There is not.

This is not an over-reaction; indeed, we believe this is the tough but responsible action. Opening schools safely takes resources. That is an inconvenient truth for some, especially considering that many people demanding to fully reopen our school buildings for in-person instruction have never advocated for fully funding our schools to begin with. While we see professional sports leagues aiming to provide daily tests to 100% of their athletes, there does not seem to be a single school reopening plan that attempts to commit to provide testing for students or school employees who want it. We have seen the federal government send billions of dollars to airlines and huge corporations in the wake of the pandemic, but we have seen far less urgency and far, far less funding directed to helping our public schools weather this time of crisis.

We should not accept lower safety standards in our schools than we do in our stores, our restaurants, and our barber shops and salons. Many schools do not have the resources or physical capacity to maintain basic protective steps, such as adequate physical distancing, appropriate supplies of PPE, rapid testing for staff and students, sufficient cleaning supplies, and high-quality ventilation systems to avoid the recirculation of air. We need to face reality: too many schools in Maryland have restrooms that lacked soap or paper towels on a normal day before the pandemic. In the face of no additional funding at the federal, state, or local level—let alone threatened budget cuts—it is not realistic to believe that all schools will be equipped with additional and more expensive necessities to stay safe on a daily basis.

The federal funds provided through the CARES Act have largely back-filled unanticipated expenses incurred to close out the last school year. Well-intentioned plans for hybrid learning would require levels of new funding that are not even being contemplated and are impossible to imagine being available for the start of the coming school year. Instead of demanding school systems do more with less, we should continue to unite in our advocacy for additional federal aid and bold state action.

We strongly believe that students gain the most academically, socially, and emotionally when they can learn in-person with their peers, but that learning must take place in a healthy and safe environment. Unfortunately, the facts and science do not support the notion that returning educators and students to schools is safe. Starting the school year unsafely would not be good for our students, especially if another abrupt closure and shift to distance learning becomes necessary. Moreover, seeing their teachers, peers, or family members become ill due to a school-based spread of coronavirus would be traumatizing. Starting the school year unsafely will likely only postpone when we can fully return to safe in-person learning. Loss of learning can be made up. Loss of life cannot.

There are no perfect solutions. Clearly, reopening schools without a thorough understanding of the resources, protocols, and costs to ensure and protect public health would be irresponsible. In light of this, demanding 100% in-person instruction under the circumstances is unsafe and unwise. An adequate hybrid plan requires all the safety protocols of in-person learning as well as addressing all the technology divides of virtual learning. Each of these would require more staff members. Without significant emergency federal or state funds, such an undertaking would be prohibitively expensive. We certainly saw tremendous inequities and learning loss when forced into crisis virtual learning at the end of the last school year. We now better understand the flaws of virtual learning and have a better sense of how to fix them. Virtual learning will not be perfect, but it will save lives.

The most prudent course of action now is to focus on how we can provide the highest possible quality of virtual learning during the first semester of the school year, during which time we hope that the virus is mitigated to a level that will allow for a subsequent expansion of in-person learning. To do that, we must focus our plans and resources to:

• reach a 1:1 student to device ratio as soon as possible;

• increase internet access to students and educators who lack it at home;

• continue to run school-based meal services;

• expand professional development for educators and training and resources for students and families to increase virtual learning fluency;

• engage in trauma-informed practices; and,

• deploy crisis intervention teams where needed.

These are the immediate needs that must be addressed with the limited time and resources districts have before the school year begins. We must concurrently build long-term plans for how we will address the learning gaps and inequities that we have always known to exist and combat the structural factors that prevent Black and Brown students from receiving an equitable education and opportunity.

We are well aware that prolonged virtual learning is challenging for parents as well as for educators and students, as is a hybrid model. We urge state and county leaders and employers to be accommodating to their employees who are parents with flexible or remote work policies and state-facilitated childcare similar to what was done for healthcare workers. We must be in this together and have empathy for one another.

We must rise above politics and focus on the reality and complexities of safely reopening schools. If we open our schools too quickly and without adequate safety precautions, the result will be that some educators, students, and their family members will contract the coronavirus. Some will recover, some will face debilitating health consequences or healthcare bills that they cannot pay, and some will die. These are stubborn facts. And they are costs and consequences that we must refuse to accept.

A perfect solution does not exist. A safe one does. We urge you to support this course. We stand ready to work with you to ensure that the coming school year is as safe and successful as possible for all of Maryland’s students and educators.

Sincerely,

Cheryl Bost, President, MSEA

Diamonté Brown, President, BTU

Dr. Edna Harvin Battle, President, Maryland PTA