By Adam Pagnucco.

Part One of this series laid out the rules and methodology for how we determined MoCo’s most influential people. These lists were developed by adding together the nominations of 85 people who are themselves extremely knowledgeable and influential. Today, we continue the list of the most influential non-elected people in MoCo.

12. Steve Hull, Editor-in-Chief and Publisher, Bethesda Magazine/Bethesda Beat – 9 votes

Source: While Bethesda Magazine / Bethesda Beat is not a political publication it has become one of the main local sources of news which means which stories are run and what information they present have influence. Just avoid the comment section!

AP: Let’s just state the obvious. Without Steve, MoCo would be close to a news desert. Steve would do just fine if all he had was Bethesda Magazine, but thank God he also runs Bethesda Beat. It is essential reading for anyone who cares about the community.

11. Josh Kurtz, Co-Founder and Editor, Maryland Matters – 10 votes

AP: As if being the best political writer in the state wasn’t enough, Josh had to go and found Maryland Matters, which is now the single best place to read about state politics. Political junkies all over the state are grateful!

10. Gustavo Torres, Founder and Executive Director, CASA – 11 votes

Source: Head of CASA only grows as a force to reckon with.

AP: From a church basement to the pinnacle of state and local politics, Gustavo is arguably the most powerful immigrant advocate in the entire Mid-Atlantic region. As CASA gets bigger along with the immigrant population, there is no end in sight to its influence.

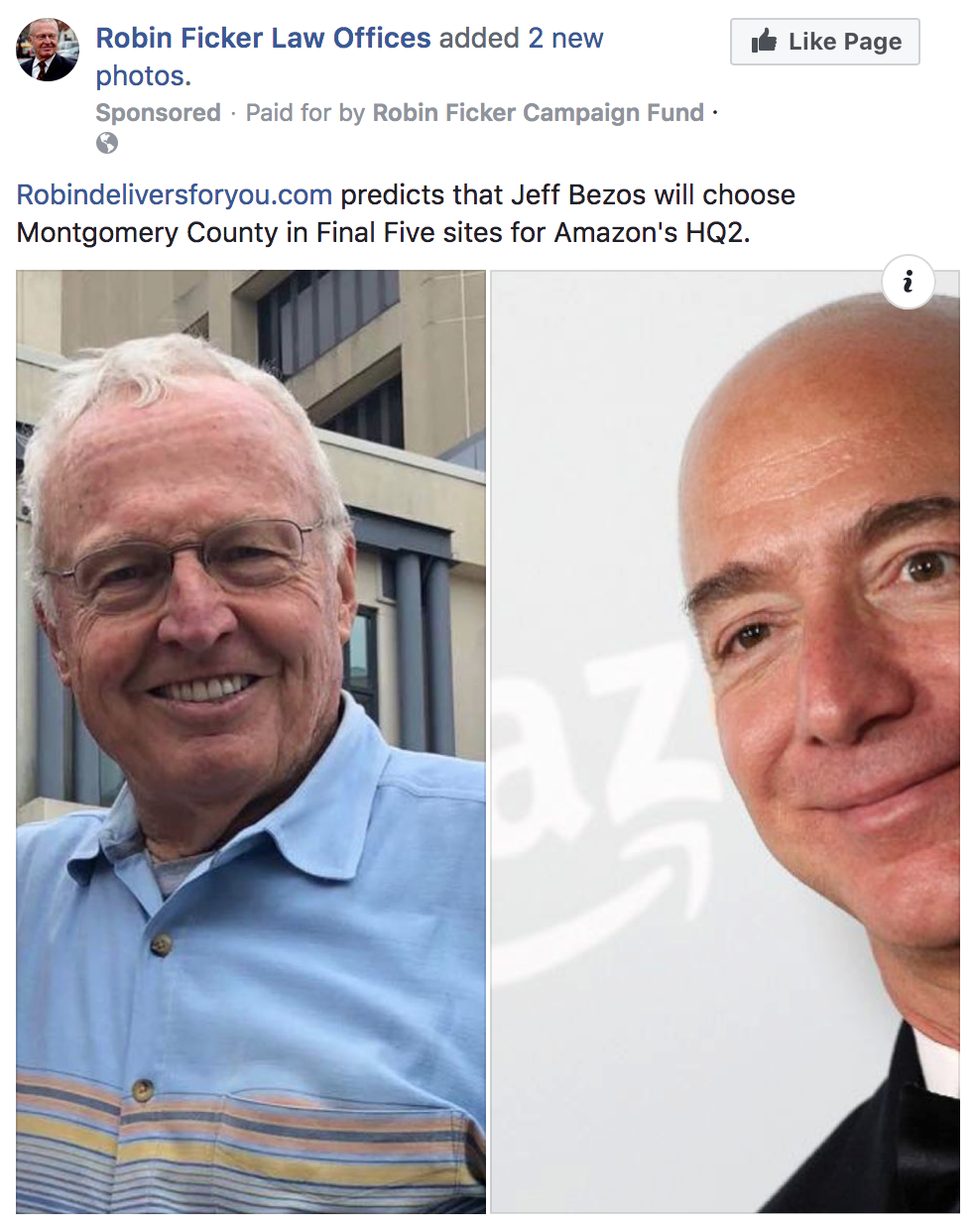

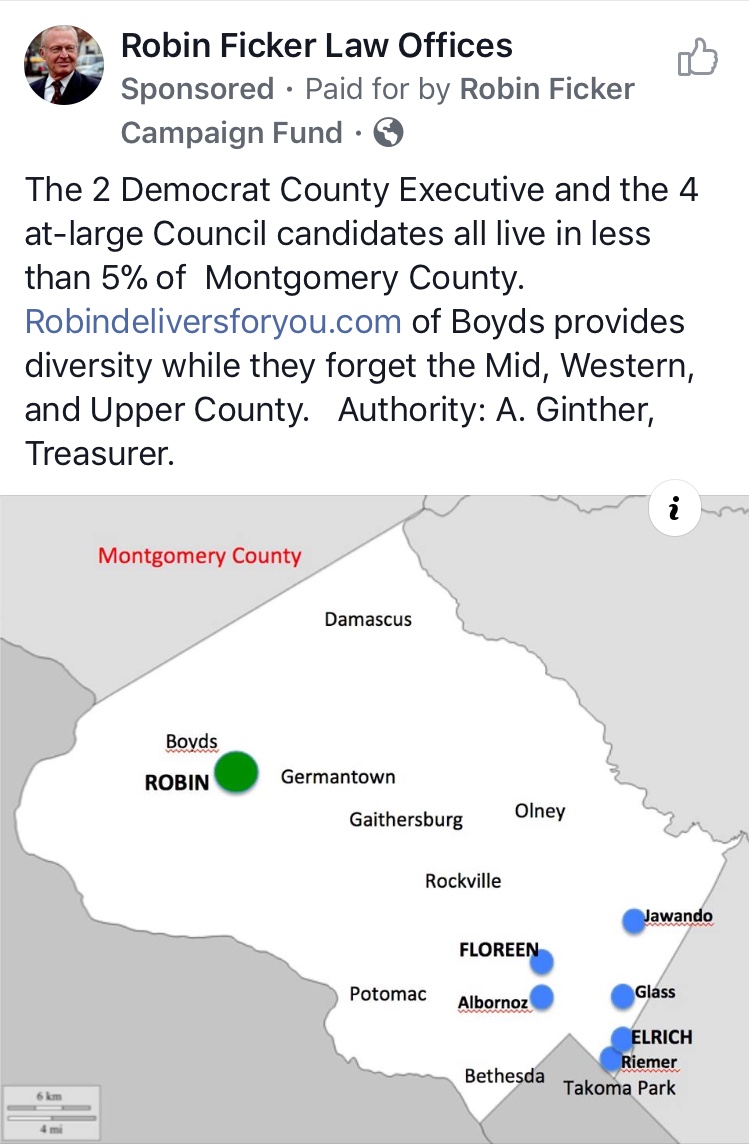

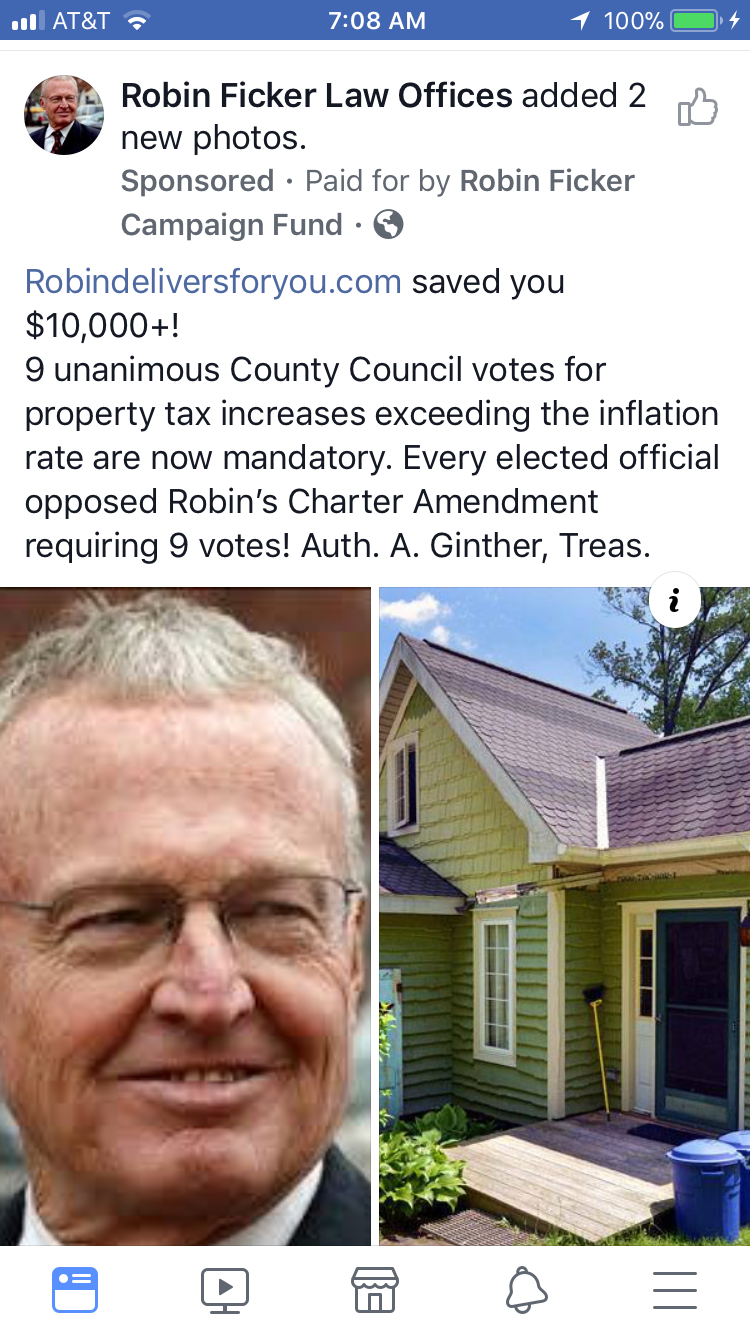

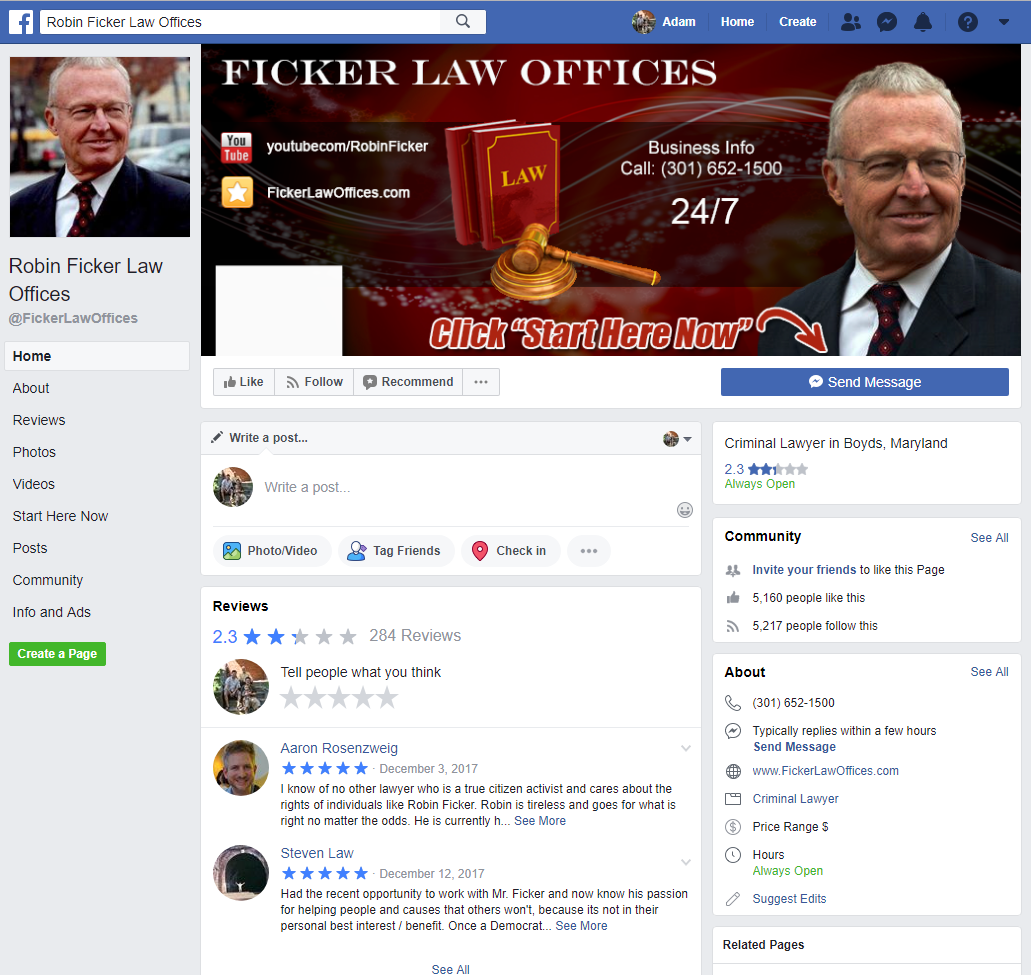

9. Robin Ficker, Attorney, Former Delegate and Political Heckler – 12 votes

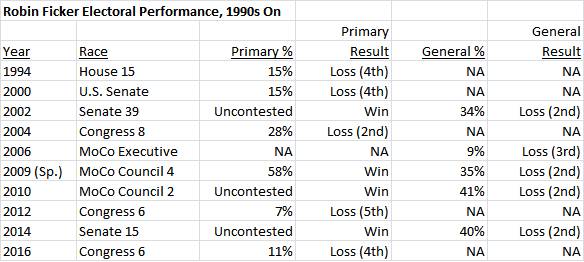

Source: His ballot measures have passed and upended things. He’s a fool of great consequence.

Source: Ficker knows how to craft winning ballot petitions and campaigns behind them. Ficker’s smarts are masked by his nutty personality, which causes people to underestimate him.

Source: Has accomplished more than some elected officials.

Source: May be obnoxious and annoying but his referendum drives influence the county.

Source: Crazy, but holds outsized influence.

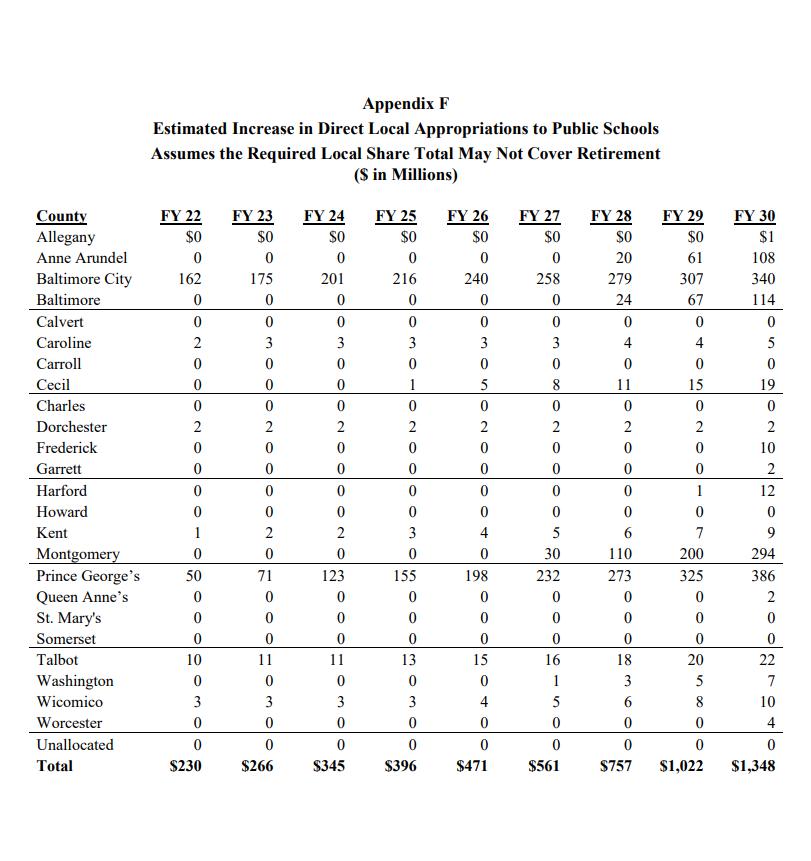

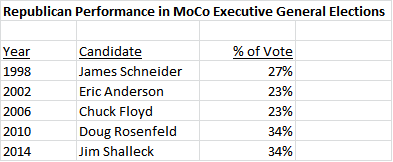

AP: Ficker doesn’t get much love from my sources but one could make the case that he is actually the most influential non-elected person in the county. Who else has nearly single-handedly passed two charter amendments in the last twelve years with another possibly on the way? He has far more influence now than he ever did in his one term as a Delegate, and if his new anti-tax charter amendment passes, it will have a huge impact on county government for a loooooooong time.

7 (tied). Diana Conway, President, Women’s Democratic Club – 14 votes

Source: President of the Women’s Democratic Club, energizer bunny energy, often found walking the halls of Annapolis or e-mailing Councilmembers, throws a who’s who holiday party.

Source: Extremely connected, a force. Strong voice and everyone knows where she stands. Unafraid to go against the tide.

Source: Diana Conway is the president of the Women’s Democratic Club which was a pretty sleepy affair until Linda Kolko’s presidency and continuing through the presidency of Fran Rothstein. Now, they co-sponsor all sorts of events with “Do the Most Good,” and “J Walkers” and “Resist” and some others who I hope would forgive me for not having their names on the tip of my keyboard.

AP: Her nickname is Madam Kickass and that is the double truth, Ruth! Few people in the county can match Diana’s brains, tenacity and sheer capacity to do anything she decides to do. Her presidency of WDC is only the latest sign of her growing influence. PS – I feel sorry for the bureaucrats who have to answer her emails about artificial turf fields!

7 (tied). Rich Madaleno, Director, Montgomery County Office of Management and Budget and Former State Senator – 14 votes

Source: The budget whisperer. He plays a critical role in explaining how the county budget works to, well, everybody but especially Marc Elrich. Retains great Annapolis contacts.

Source: He’s become one of the county executive’s top defenders and surrogates while continuing to be an idea machine.

AP: The budget director is always important, but Rich’s experience at the state level and his status as a long-time (and effective!) former elected official make him even more influential than his position warrants. The budget crisis resulting from COVID-19 makes his role more critical than ever.

Part Seven will contain the much-awaited, soul-searing conclusion!