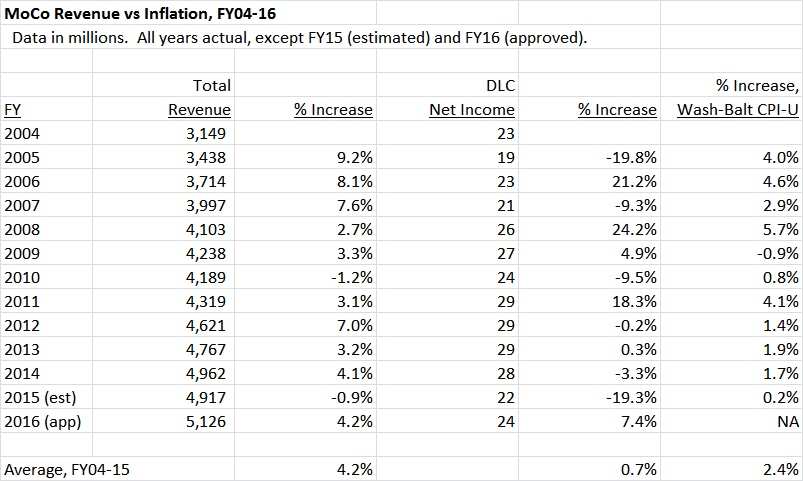

There are two major components to frustration with Montgomery County’s alcohol laws: (1) the distribution monopoly by the Department of Liquor Control (DLC), and (2) the limitations on where consumers can buy alcohol. Del. Eric Luedtke’s (D-14) bills would address the latter (see press release below).

In a nutshell, one bill would allow supermarkets to get around the current limits that make it impossible for them to sell all types of alcohol at multiple locations by allowing them to open stores within their stores operated by the DLC.

I suspect supermarkets will be chary of giving up sales space when they cannot control the sales experience and have to negotiate over which products are sold. My bet is that they would much prefer to be able to sell just beer and wine within their own stores. Hopefully, the bill can be amended towards that end.

However, MCGEO, the DLC union, will likely resist any effort to move away from the absolute DLC control model. Though supermarket employees are unionized, it is a different union, and MCGEO won’t want to lose the opportunity to expand its muscle–and ability to protect the hated distribution monopoly.

The second bill loosens certain restrictions on DLC stores and Sunday alcohol sales. My bet is that non-DLC stores that sell beer and wine will fight allowing DLC stores to sell soft drinks and cold beer and wine. They’ll be outraged that they still have to deal with DLC’s distribution monopoly yet see the DLC encroaching on a valuable share of their business.

Bottom Line: If some major kinks can be worked out, especially the need for a DLC-operated store within a store, consumers will regard this as a major step forward. But the bills do nothing to address the hated distribution monopoly that jacks up prices and drives restaurant business out of the county.

Here is Del. Luedtke’s press release:

Delegate Eric Luedtke Seeks to Make Montgomery Alcohol Laws More Consumer Friendly

Bills include provisions that will eliminate outdated blue laws, expand choices for retail alcohol consumers

Montgomery County, MD, October 30, 2017 – Delegate Eric Luedtke (D-Burtonsville) announced plans today to introduce two bills aimed at making Montgomery County alcohol laws more consumer friendly. One of the bills, MC 16-18, will allow for separate beer, wine, and liquor dispensaries to be located inside grocery stores. This store-within-a-store model has been used successfully in other states. Under this model, large grocery stores will be eligible to have a separate store located within them selling alcohol, similar to coffee shops or bank branches located in many grocery stores now.

The second bill, MC 4-18, titled “The Montgomery County Alcohol Modernization Act of 2018,” will overhaul a number of outdated laws that limit consumer options and place unnecessary limits on businesses. Among its many provisions, this bill will allow county liquor stores to sell cold beer and wine, soft drinks, and growlers. The bill also eliminates some of the last remaining blue laws in Montgomery County, such as laws that prevent some alcohol licensees from serving alcohol as early on Sundays as they do on other days of the week.

Delegate Luedtke stated about this effort, “Our debates about alcohol laws in Montgomery County have too often ignored consumers. The most common complaint I hear from residents about our alcohol laws is a lack of beer and wine in grocery stores. It’s time we focused more on consumer needs and fixed some of these outdated laws.”

Both pieces of legislation will be filed as local bills, and there will be public hearings held on them before the Montgomery County Delegation in December.

###

Delegate Eric Luedtke represents District 14 in Montgomery County, which includes Brookeville, Burtonsville, Damascus, Olney and parts of Silver Spring. Delegate Luedtke is chair of the Education Subcommittee on the House Ways and Means Committee.